Core Business Performance

Deposit Intake

The Bank offers two tariff plans -Baspana and Tabysty – that allow depositors to choose both the savings period and the interest rate they wish to pay on a future housing loan. Depositors must accumulate 50 percent of the contractual amount. Interest on savings ranges from 2 percent to 5.5 percent per annum (EAR, including the state bonus, up to 14 - 17.1 percent).

Monthly contributions are calculated so that, if made evenly throughout the saving period, the customer will reach the required evaluation score by the end of the term. Early lump‑sum payments during the initial accumulation stage raise the evaluation score more quickly.

Deposits may be topped up with surplus funds from a depositor’s individual pension account. If a contributor to the Unified Accumulative Pension Fund has savings above the sufficiency threshold, a lump‑sum withdrawal may be transferred to an Otbasy Bank deposit and later used to obtain a housing loan.

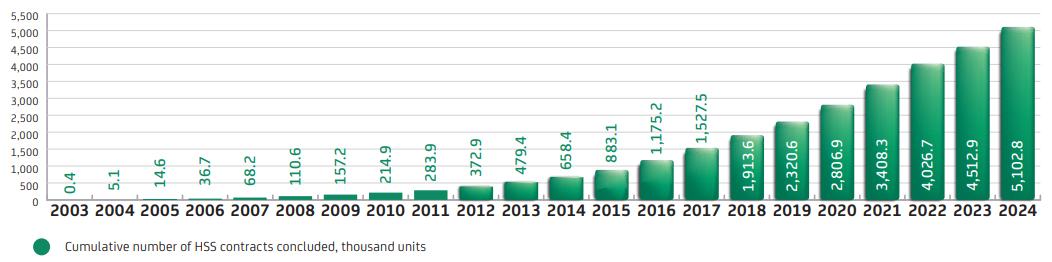

Dynamics of HCS contracts conclusion

The steadily rising pace of contract signings demonstrates growing public participation in Kazakhstan’s housing construction savings system.

Loan Issuance

The Bank provides its depositors with housing, interim, and preliminary housing loans to support activities aimed at improving their living conditions.

A housing loan

is issued subject to the following conditions: the depositor must accumulate the minimum required amount, observe a saving period of at least three years, achieve the minimum evaluation score (determined individually for each tariff plan), confirm their solvency, and provide collateral sufficient to cover the loan amount. The loan term ranges from 6 months to 25 years, with an interest rate of 2 % to 5 % per annum (EAR ranging from 2 % to 5.8 %).

An interim housing loan

is issued if the depositor makes an early or lump-sum contribution of at least 50 % of the contractual amount, followed by lending within the limits of that amount. Solvency and collateral adequacy must also be confirmed. The loan term is up to 25 years, with interest rates ranging from 2 % to 8.5 % per annum (EAR ranging from 2 % to 9.6 %).

A preliminary housing loan

is issued under government housing programs and the My Home Program. During the term of the loan, the borrower pays only interest and simultaneously contributes to their deposit account until reaching 50 % of the contractual amount. Once the accumulation period is complete, both the accumulated savings and a housing loan are used to repay the preliminary loan. The combined saving and repayment period for a preliminary loan can be up to 8 years, with interest rates from 2 % to 14.4 % per annum (EAR starting from 2.1 %).

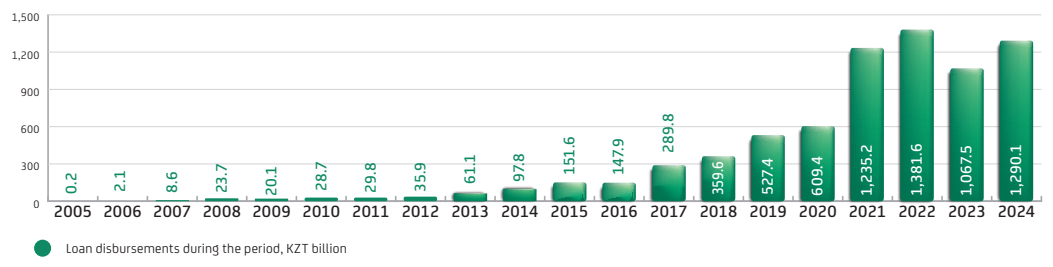

Dynamics of Loan Disbursement

The Bank has demonstrated consistent growth in loan issuance throughout its entire period of operation. The dynamic expansion of the loan portfolio since 2012 is largely attributable to lending to the population under state and regional housing programs, as well as the Bank’s own programs for each market segment.

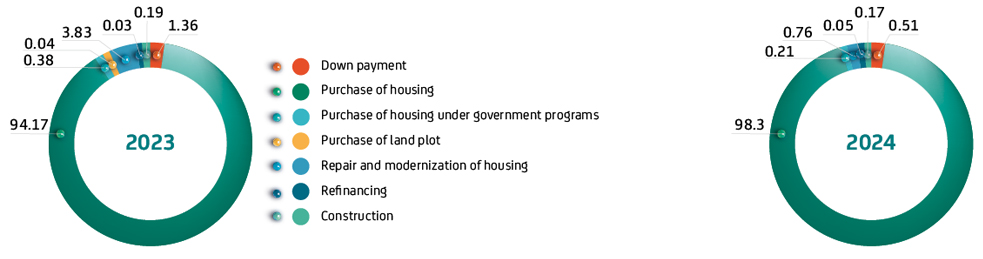

Loan Structure by Purpose

The majority of the Bank’s income is generated from interest on issued loans. The Bank’s most profitable product is the interim loan. In 2024, interim loans accounted for 75 % of the total volume of loans issued. During the reporting year, the Bank initiated a phased approach to differentiate interest rates on interim loans in order to strengthen the culture of saving. New minimum waiting periods (based on the minimum evaluation score) were introduced for obtaining interim housing loans – at least 6 months. An interim loan may be issued with a minimum evaluation score of 5.

Target Performance Indicators Assessment

|

Indicator Name |

Actual, 2021 |

Actual, 2022 |

Actual, 2023 |

Target, 2024 |

Actual, 2024 |

Achievement, % |

|---|---|---|---|---|---|---|

|

Housing Savings Contracts (units) |

601,370 |

618,422 |

486,265 |

– |

589,927 |

– |

|

Deposit Portfolio (KZT million) |

1,509,092 |

2,140,681 |

2,362,586 |

2,349,623 |

2,421,456 |

103 |

|

Loans Issued (KZT million) |

1,235,168 |

1,381,599 |

1,067,534 |

1,223,009 |

1,290,137 |

105 |

|

Loan Portfolio (KZT million) |

2,083,795 |

2,968,315 |

3,202,303 |

3,381,812 |

3,379,713 |

99.9 |

Dynamics of Loans Disbursed, KZT billion

Throughout its entire period of operation, the Bank has signed 5.1 million contracts with a total contractual amount of KZT 18.2 trillion. The system has attracted more than 2.8 million depositors, with total deposits reaching KZT 2.4 trillion. Nearly one-third of the population’s long-term savings (31 %) are held at Otbasy Bank. Moreover, over half of the national mortgage portfolio (55 %) is comprised of Otbasy Bank’s loans. In other words, more than half of all mortgages in Kazakhstan are issued by Otbasy Bank.

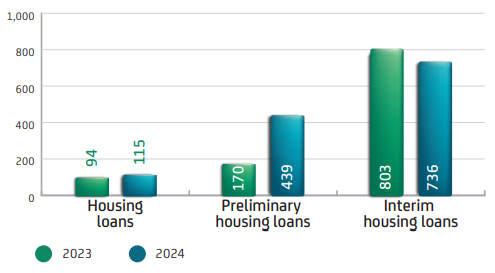

The Bank issues loans exclusively to individuals. As of the end of 2024, interim housing loans totaled KZT 736 billion. Preliminary housing loans grew by 2.5 times compared to 2023, reaching KZT 439 billion at the end of the year. Housing loans amounted to KZT 115 billion.

An analysis of the Bank’s key performance indicators during the implementation period of its Development Strategy demonstrates sustained growth, reflecting the demand, competitiveness, and flexibility of the Bank’s products on the Kazakhstan financial market.

The primary focus of our country’s policy remains the social well-being of its citizens, with particular emphasis on housing. To this end, various preferential housing programs have been introduced across the country, with special attention given to socially vulnerable population groups. Otbasy Bank serves as the operator of these state housing programs. Over the past twenty years, Otbasy Bank has become a reliable partner for many Kazakhstanis in resolving their housing needs.

Throughout its operational history, the Bank has successfully implemented the following state housing programs: the 2005–2007, 2008–2010, and 2011–2014 Housing Construction Programs; the Affordable Housing 2020 Program; the Regional Development Program through 2020; the Nurly Zhol State Infrastructure Development Program for 2015–2019; and the Nurly Zher State Housing Construction Program. These programs have now been completed.

During the reporting year, the Bank implemented the Housing and Utilities Infrastructure Development Concept for 2023–2029 (hereinafter referred to as the Concept). The Bank acts as the operator of the Concept and its subprograms 2-10-20 and 5-10-20, offering loans to socially vulnerable groups registered with local executive bodies. These groups include persons with disabilities (Groups 1 and 2), families with or raising children with disabilities, large families, mothers, orphans, and children without parental care. Under the Concept, the Bank issues preliminary housing loans at interest rates of 2 % or 5 % per annum, depending on the borrower category:

- Eligible for 2 % per annum:

- Orphans and children without parental care;

- Mothers of many children awarded the Altyn alka, Kumis alka medals or earlier awarded the Mother Heroine title, mothers awarded the Motherhood Orders of Classes I and II, as well as large families;

- Persons with disabilities (Groups 1 and 2);

- Families with or raising children with disabilities;

- Other categories of registered citizens eligible for loans at 5 % per annum under the Concept.

All participants in the Concept use the loan funds to purchase housing constructed by local executive bodies.

In 2024, the Concept provided for the implementation of 118 properties (6,605 apartments) with a total area of 648,000 square meters, amounting to KZT 74.2 billion.

Under the state programs (including the Concept, and remaining housing stock from expired programs such as Nurly Zher and Shanyrak), a total of 9,004 loans were issued in 2024 for KZT 108.1 billion. Of these, 5,145 loans for KZT 59.6 billion at 5 percent interest and 3,859 loans for KZT 48.5 billion at 2 percent interest were issued. Loans under the 5-10-20 program were funded using unused budget allocations from 2023 totaling KZT 39.7 billion, as well as recycled repayments. Under the 2-10-20 program, the Bank received KZT 33.6 billion from the national budget in 2023 (in tranches of KZT 20 billion, 12.2 billion, and 1.4 billion). In 2024, this funding was used to provide loans to persons with disabilities, orphans, large families, and families raising children with special needs.

From 2019 to 2024, the Bank issued a total of 77,699 loans under all state programs, amounting to KZT 810,056 million, covering a total housing area of 4,702,572 square meters.

In 2022, Kazakhstan launched a program to subsidize a portion of the rental payments for housing leased from the private rental market. This initiative supports citizens registered with local executive bodies as being in need of housing. Otbasy Bank was appointed as the operator of this program and continued its implementation during the reporting year. In 2024, a total of KZT 11.7 billion was allocated to the program, including KZT 8.3 billion from the republican budget and KZT 3.4 billion from local budgets. Of this, KZT 9.7 billion was utilized (KZT 7.7 billion and KZT 1.9 billion respectively), and the unused balance was returned to the republican and local budgets. By the end of the reporting year, 10,403 applications had been funded with payments totaling KZT 9.7 billion to support large families, families raising children with disabilities, orphans, and persons with disabilities (Groups 1 and 2).

Since 2023, the Bank has been implementing the state-run With a Diploma to the Village program. Within the framework of this program, the Bank has developed a remote application submission system for professionals in healthcare, education, social welfare, culture, sports, the agro-industrial sector, and civil servants working in rural akimat administrations, who relocate to live and work in rural settlements. In addition, a personal account interface has been created for local authorities to manage submitted applications. To improve customer service and increase the digitalization of public services, the entire application process was fully transitioned to an online format. This transformation helped save time for professionals in education, healthcare, and agriculture, as well as for local government administrators processing applications for budget loans aimed at rural development.

The Bank signed 183 commission agreements with local executive bodies for a total of over KZT 30 billion. Under the program, 3,263 loans were issued totaling KZT 26 billion, along with 2,081 relocation grants amounting to KZT 776 million.

Regional programs are aimed at retaining and supporting specialists who are in high demand in the regions, such as doctors, teachers, journalists, athletes, cultural workers, and professionals from other fields. These programs are implemented through repayable budget loans provided by local executive bodies to Otbasy Bank since 2017.

Otbasy Bank actively promotes regional programs focused on supporting youth across Kazakhstan. As of today, youth-focused programs are being implemented in the cities of Astana and Almaty, as well as in the regions of Abay, Aktobe, Almaty, Atyrau, Zhambyl, Zhetysu, West Kazakhstan, Karaganda, Kostanay, Kyzylorda, Mangystau, Pavlodar, North Kazakhstan, and Ulytau.

The total volume of financing for regional programs amounts to KZT 198.9 billion, including KZT 155.6 billion from local akimats and KZT 43.3 billion from Otbasy Bank. In 2024 alone, the total volume of regional program financing reached KZT 79.1 billion (KZT 61.2 billion from local akimats and KZT 17.9 billion from Otbasy Bank).

Youth programs are included in the overall financing of regional programs and account for KZT 142.9 billion (KZT 110.6 billion from local akimats and KZT 32.3 billion from Otbasy Bank). In 2024, youth program financing reached KZT 44.9 billion (KZT 35.2 billion from local akimats and KZT 9.7 billion from Otbasy Bank).

In 2024, under regional programs, a total of 2,891 loans were issued for an aggregate amount of KZT 48.9 billion KZT, including 2,250 loans totaling KZT 38.1 billion under youth programs. This reflects a successful example of productive collaboration between the Bank and local executive bodies in the regions.

Today, housing support is available not only for employees of public enterprises but also for staff of private companies – factories, enterprises, healthcare institutions, and other businesses interested in supporting their workforce. To reduce the social burden on the national budget and retain young professionals in the regions, the Bank encourages large companies to annually consider participating in the Corporate product.

The total amount of funding allocated under the Corporate product reached KZT 5.6 billion, including KZT 2.3 billion in 2024. These funds supported cooperation with the following companies: Kazchrome TNC JSC, Sokolov-Sarbai Mining and Processing Production Association JSC, Bogatyr Komir LLP, Eurasian Energy Corporation JSC, KazSMU LLP, BK-STROY LLP, Sheber-SVT LLP, Daily Food Astana LLP, and Daily Food Ltd LLP.

Overall, under the Corporate product, the Bank helped improve the housing conditions of 237 enterprise employees, with a total amount of KZT 3.5 billion, including 96 loans totaling KZT 1.57 billion issued in 2024.

The program for military personnel remains one of the Bank’s most in-demand products. To fund the program, the Bank raises capital on market terms and also uses its own resources. Currently, the Bank is the only financial institution where special deposits are granted a protected status and legal immunity. In 2024, the Bank issued 1,772 loans under this program, totaling KZT 53.5 billion.

Since early 2023, the Bank has been implementing Kazakhstan’s first Green Mortgage program for the purchase of apartments in energy-efficient residential complexes built according to green standards, thereby supporting a strategic initiative to promote environmentally sustainable housing. The program is aimed at protecting public health and the environment.

The key condition of the program is that the purchased housing must comply with a green standard certified under one of the systems operating in Kazakhstan (OMIR, GOST R, BREEAM, LEED), regardless of the certification level.

This means that developers use environmentally friendly and safe materials in construction, develop and landscape the surrounding areas, ensure well-planned layouts, provide air temperature control within apartments, and ensure access to public transport, among other criteria.

To expand cooperation with key players in the construction sector, the Bank signed 25 memoranda of partnership with the country’s leading construction companies. In 2024, 763 loans were issued under the program for a total of KZT 18.6 billion.

Funds Attracted

To ensure the Bank’s full-fledged operations and to meet its obligations to depositors in issuing housing loans, the Bank uses its own funds, funds allocated from the state budget and the budgets of local executive bodies, customer deposits, and borrowed funds from the financial market (including the issuance of debt securities and loans from various organizations).

Over the entire period of its operations, the Bank has attracted KZT 897 billion in budgetary funds under state and regional programs. As of 1 January 2025, KZT 859 billion, or 96 percent of the total attracted funds, had been utilized (including revolving funds, KZT 1,030 billion, or 115 percent of the total).

In 2024, to implement the Nauryz program, the Bank placed social bonds on the platform of Kazakhstan Stock Exchange JSC totaling KZT 209,849,631,000 (at nominal value): KZT 170,500,000,000 at an annual yield of 14.25 percent, and KZT 39,349,631,000 at an annual yield of 15.25 percent.

Sales System

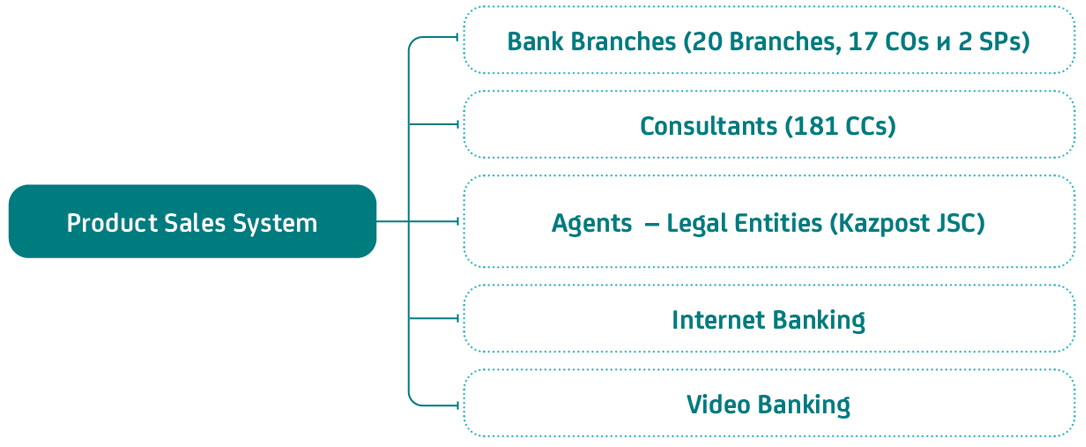

The Bank’s operations are characterized by a consistently high pace of growth, as evidenced by the increase in its key performance indicators. This positive dynamic has been largely driven by the effective performance of the Bank’s sales system, which includes branches, service centers and points, consultants and agents (organizations providing agency services to the Bank under signed agreements), internet banking, video banking, and other tools.

Key Participants of the Bank’s Sales System

The Bank is committed to building an infrastructure where customers can access its products and services in a manner that is convenient for them – at a time, place, and via a channel of their choosing.

To this end, the Bank has implemented the following service channels:

- Bank branches (including regional branches, service centers, service points, and the call center);

- Bank consultants (consulting centers and field service);

- Consulting operators (digital guides) at Bank branches assisting with remote service channels;

- Consulting operators (postal agents) assisting with use of remote service channels;

- Agent – Kazpost JSC;

- Video banking;

- Internet banking;

- The Bank’s mobile application;

The Bank’s partners (Kaspi.kz, the e-Government portal of the Republic of Kazakhstan, Halyk Bank of Kazakhstan JSC, Bank CenterCredit JSC); and communication channels including:

- The Bank’s corporate website;

- The Quanysh chatbot (via WhatsApp, Telegram, Instagram, Facebook, VKontakte);

- The Bank’s official pages on social media platforms (Instagram, Facebook, VKontakte), etc.

In 2024, the Bank invested time and financial resources into the active development of digital technologies and customer service solutions.

By the end of the reporting year, the Bank carried out 4.7 million customer transactions, of which 78.3 % (3.7 million transactions) were conducted through remote service channels. As of 1 January 2025, the share of transactions via remote channels was as follows:

- Internet banking – 72.3 % or 3,427,003 transactions;

- Video banking – 6 % or 282,578 transactions.

Transactions conducted at Bank branches totaled 676,022 (14 % of all transactions). The agency network processed 354,902 transactions (7 % of all transactions). The Customer Satisfaction Index (CSI) for services at Bank branches reached 4.76 points.

Note: The CSI measurement for branch services is measured in accordance with the methodology adopted by Otbasy Bank JSC for tracking CSI and NPS service indicators.

Special Services for Certain Categories of Citizens

To better serve its customers, including persons with limited mobility and persons with disabilities, the Bank has implemented the following service conditions:

- Mobile consultations by non-staff consultants, who use mobile tablets to serve customers at a location of their convenience;

- A video-based sign language interpretation service for customers who are deaf or hard of hearing;

- Priority service at Bank branches for persons with disabilities;

- Installation of ramps, elevators, tactile paving with call buttons for Bank personnel, and other accessible features at Bank branches;

- Online and in-person educational sessions aimed at improving Bank employees’ competencies in respectful and effective communication with customers with disabilities. Core topics included: rules for polite communication with people with health limitations, specifics of serving customers with disabilities, and adaptation of banking services for persons with disabilities;

- All Bank branches are listed on the Information Portal of the Ministry of Labor and Social Protection of the Population of the Republic of Kazakhstan for the social protection of persons with disabilities (https://inva.gov.kz/).

In 2024, the Bank issued 1,212 loans worth KZT 14.9 billion to customers with disabilities.

Contact Center

The Bank places great importance on receiving customer feedback, striving to evolve effectively in the interest of its customers. Feedback is collected through written requests (submitted in person, by mail, by email, or through the Bank’s online platform) and verbal requests (by phone or in person at a Bank branch). Requests, if received, are accepted and processed daily.

Since 2020, the Bank has been actively introducing innovative technologies to enhance communication with customers. One of the key tools in this effort is the Quanysh chatbot. This modern tool operates on popular messaging platforms such as WhatsApp, Telegram, and Instagram, as well as through the Bank’s mobile application, providing customers with a convenient and efficient means of interaction.

In 2024, the Bank achieved the following results:

- Processed 1.1 million customer chats.

- The configured chatbot successfully processed 85.6 % of messages without operator involvement.

- The average first-response time was 14 seconds.

- Operators processed up to 10 chats simultaneously, maintaining a high Customer Satisfaction Index (CSI) of 87.9 %.

- Over 7,000 official written requests were processed through the Feedback, E-өtinish, and Prime Minister’s Blog platforms, and more than 99,000 comments were addressed on social media platforms.

- A total of 3,299,743 incoming phone calls were processed.

- The configured IVR system successfully resolved 62.9 % of calls without operator assistance.

As part of fulfilling the mandate of Baiterek Holding and implementing the directive of Kassym-Jomart Tokayev, the President of the Republic of Kazakhstan, to advance artificial intelligence, the Bank actively engaged in research and implementation of AI technologies throughout 2024 to enhance customer service quality. Over the year, the Bank conducted four large-scale pilot projects involving 11 top AI models developed by leading global companies:

- OpenAI: ChatGPT 3.5, ChatGPT 4, ChatGPT 4 omni, ChatGPT 4 omni-mini.

- Amazon Web Services (AWS): Claude 3.5 Sonnet, Claude 3.5 Haiku, Nova.

- Google: Gemini 1, Gemini 1.5, Gemini 2.

- Meta: Llama.

Following a comprehensive analysis and testing process, the Nova model by AWS, enhanced with the Cohere predictive search system, was selected. This solution became the foundation of the new chatbot – Quanysh-AI. The new system demonstrates over 90 % accuracy in responding to customer requests in Kazakh, Russian, and English.

To ensure data security and AI integration with the Bank’s internal systems, the following were developed:

A system for providing confidential information when using cloud-based LLM models.

A data encryption system enabling integration of Quanysh-AI with the Bank’s databases.

The chatbot now provides customers with access to over 40 data points across 7 key areas, including:

- personal data.

- information on deposits.

- information on the special account for military personnel.

- information on account freezes.

- information on the use of pension savings.

- information on status of applications for the rental housing subsidy program.

- information on loans.

In 2024, the Bank acquired a new chat platform and voice platform with AI integration from AWS. Additionally, a desktop application was developed, and Quanysh-AI was launched for internal testing by Bank employees. The chatbot’s functionality was rated 4 out of 5 points. In the near future, the Quanysh-AI chatbot will be deployed across the following channels: Telegram, WhatsApp, the Bank’s new mobile app, official website (hcsbk.kz), the Unified Accumulative Pension Fund portal (Enpf-Otbasy), the Baspana Market portal, Instagram, and via voice bot.

Through the integration of artificial intelligence, modernization of digital platforms, and continued improvement in customer service, the Bank has taken a major step toward innovative development. The new Quanysh-AI chatbot is not only a convenient tool for customers, but also a clear example of how technology can elevate the quality and accessibility of financial services. All of this reaffirms the Bank’s commitment to its strategic goals and values.

In line with the Bank’s strategic objectives to comprehensively transform its operations, business processes, competencies, corporate culture, and business models into a fully digital bank that maximally leverages digital technologies, the Bank continues to develop and implement innovative products based on new technologies to deliver a new customer experience. Since 2020, the Bank has operated a video banking service. In 2021, efforts were made to improve this service, including the launch of a new remote service feature – online deposit account opening via video call. Furthermore, to enhance accessibility of the Bank’s products, an online mortgage application process was introduced through a concierge service using video banking. This product combines the best of personal customer service and digital channels – a Phygital approach. The implementation of this functionality allowed customers to apply for mortgages remotely and significantly reduce visits to Bank branches, which was especially important during periods of epidemiological concern. In 2024, a total of 5,244 loan applications were submitted via video banking, totaling KZT 120 billion. Video calls have also allowed customers to receive post-deposit services remotely, saving time and enhancing convenience. This functionality was used 543,000 times. Additionally, more than 807,000 customers were served through audio support services during the year.

In 2024, the deposit portfolio of the internet banking channel achieved the following results:

- Total savings exceeded KZT 263 billion;

- Deposit inflows amounted to KZT 156.1 billion;

- Over 162,000 new contracts were opened;

- Deposit portfolio activity rate reached 64.0 percent.

As for the video banking portfolio, the following results were achieved:

- Total savings amounted to KZT 211.5 billion;

- Deposit inflows exceeded KZT 108.6 billion;

- 74,600 new contracts were signed;

- Deposit portfolio activity rate reached 38.9 percent.

To achieve planned targets and increase the loan portfolio, the following initiatives were implemented:

- 272 marketing campaigns, resulting in inflows of KZT 23.4 billion;

- 119 operational campaigns, during which over 831,000 outbound calls were made for deposit/loan sales and deposit replenishment reminders;

- In September 2024, a large-scale campaign titled State Bonus 2024 was launched. The total deposit inflow from participants reached KZT 258.6 billion, with more than 277,000 customers replenishing their deposits with an amount of 200 MCI or more.

Development of the Bank’s CRM information system continued in 2024. To enhance customer profiles with more data and to enable one-stop service, 14 upgrades were implemented. The CRM customer card was enriched with information on all operations and auto-payments made through the new mobile application and Baspana Market portal, as well as data on previously closed Bank products, including accounts, submitted applications, and applications processed through Baspana Market and the enpf-otbasybank.kz portal. New business processes were introduced to ensure timely updates of CRM data, including an improved deduplication procedure for customer cards.

Additional integrations were carried out with five Bank systems: Service Desk, BPM 2.0, TSA-VIDEOBANKING, the new mobile application, and ENPF-OTBASYBANK.KZ. These integrations enabled not only data retrieval into the CRM but also data transmission to those systems. Operators gained the ability to register Service Desk requests and customer requests into BPM 2.0 directly from the CRM interface.

Software enhancements were also implemented in the Genesys platform to support real-time tracking of key Contact Center performance metrics, operator status monitoring, and skill-group control.

To promote digital service adoption among customers, the number of digital assistants in Bank branches was increased to 118 employees in 2024, helping to expand the share of remote banking services. Compared to 2023, the share of operations moved to digital servicing increased from 42 % to 53 %.

Responsible Lending and Financial Products

The Bank conducts its lending activities by providing loan products across all regions of the Republic of Kazakhstan. The main focus of the Bank’s lending activities is the provision of loan products to its customers. The Bank provides the following types of loan products to HCS depositors:

- Housing loans;

- Interim housing loans;

- Preliminary housing loans.

Loan products are offered on standard terms to all Bank customers in the national currency of the Republic of Kazakhstan. Loans are issued to HCS depositors on the basis of housing construction savings agreements and bank loan agreements (Housing Loan, Interim Housing Loan, Preliminary Housing Loan) concluded with them in accordance with the Bank’s internal documents on granting loans and the Bank’s tariff programs.

The loan terms for Bank customers are determined by the terms of the tariff program selected by the customer.

The terms of use, interest rates, methods of securing loan repayment obligations and other basic terms and conditions of the Bank’s loan products and services are established by tariff programs and other internal documents of the Bank.

The Bank’s interest rate for granting a loan product is determined by the terms and conditions of the HCS agreement. Bank loan agreements obligatorily specify the method of loan repayment at the borrower’s choice from those offered by the Bank as of the date of conclusion of the bank loan agreement. The loan interest rate is set at the time of execution of the housing construction savings agreement and remains fixed throughout the term of the agreement. The fixed interest rate is not subject to unilateral change. When a HCS depositor switches from one tariff program to another on his/her own initiative, the fixed loan interest rate may be changed downward/upward as agreed by the parties during the term of the HCS agreement, subject to its terms and conditions and in accordance with the laws of the Republic of Kazakhstan and the Bank’s internal documents.

In bank loan agreements, the Bank specifies the full list of commissions and other fees and their amounts to be charged in connection with loan disbursement and servicing under the executed agreement.

The Bank is entitled to charge commissions and other fees, but adheres to a policy of minimum tariffs for its services. This approach is aimed at maximizing the attraction of new customers to the housing construction savings system and contributes to the expansion of the customer base.

Advertising and PR Activities of the Bank

The Bank promotes the housing construction savings system by informing the public about affordable opportunities to purchase housing under favorable conditions. A key part of this effort involves implementing comprehensive PR initiatives aimed at improving financial literacy among Kazakhstanis and increasing awareness of the Bank’s products and programs.

In 2024, the Bank prepared and published 96 press releases in Kazakh and Russian on topics such as the benefits of the housing construction savings system, accrual of state premiums, implementation of government programs, and the launch of two new housing programs, Otau and Nauryz. Other topics included the Asyl Meken program for residents of rural areas and district centers, youth-oriented programs, the advantages of the AQYL education deposit, and the National Fund for Children program. As a result of these press releases, 912 unpaid media materials were published.

Additionally, 12 interviews and media appearances by Bank executives were featured in national media outlets throughout 2024.

Lyazzat Ibragimova, Chair of the Management Board, gave two interviews to the national newspaper Vremya regarding the launch and implementation of the Bank’s proprietary Otau program. The article was titled Otau for Kazakhstani Families. Another article in the same publication, titled Honest, Open, Fair, covered the Bank’s role as a national development institution.

Lyazzat Ibragimova, Chair of the Management Board, also took part in a briefing organized by the Central Communications Service on the topic of the Nauryz housing program.

On the Jibek Joly TV channel, she appeared in the program UADE, where she spoke in detail about the Bank’s mission and goals, its role in supporting the population with housing solutions, the accrual of state bonuses, and its function as a national development institution.

An information campaign was conducted around the Bank’s Issuer Day held at the Kazakhstan Stock Exchange (KASE), featuring participation by Lyazzat Ibragimova, Chair of the Management Board. Materials on the Bank’s issuance of its first social bonds to finance participants in the Nauryz housing program were published in leading Kazakhstani business media.

On the Atameken Business channel, Lyazzat Ibragimova, Chair of the Management Board, gave an interview on the Bank’s activities in 2024 and plans for 2025.

Throughout the year, the Bank actively informed the public about its participation in the State Education Savings System (SESS), allowing Kazakhstanis to open AQYL educational deposits. In November 2024, media coverage highlighted a young resident of Semey who became the 50,000th AQYL depositor.

Extensive public outreach efforts were carried out for the launch of the new Otau and Nauryz housing programs. With the involvement of the Bank’s press service, 445 unpaid publications were released in the media covering the program terms, application procedures, and stories of new homeowners.

Following the signing of the Act on Amendments and Supplements to Certain Legislative Acts of the Republic of Kazakhstan Regarding Housing Policy Reform by Kassym-Jomart Tokayev, the President of Kazakhstan, the Bank conducted a comprehensive information campaign. This included clarifying its designation as a national development institution and its centralized authority to manage the housing waiting list. A total of 70 unpaid media materials were published on this topic.

Information support was provided for forums held for employees of ERG Group’s town-forming enterprises in the single-industry towns of Aksu and Rudny, promoting the Corporate product, Otau and Nauryz programs, and the AQYL deposit.

Explanatory materials about the housing construction savings system, as well as stories of Bank depositors, were published in national newspapers such as Vremya, Kazakhstanskaya Pravda, Egemen Qazaqstan, and Delovoy Kazakhstan.

Throughout the year, Bank representatives participated in economic, socio-political, housing, and news programs on TV channels including Khabar, Khabar 24, Kazakhstan, Almaty, Channel 31, Eurasia First Channel, KTK, etc.

On the popular news portal nur.kz, a promotional project was launched to raise awareness about the Nauryz program. A dedicated landing page was developed and launched, featuring information on the program’s conditions and opportunities. Twelve supporting articles were published, sharing success stories from new homeowners and explaining the program’s requirements, application process, points calculation, and more.

On the zakon.kz portal, a promotional project was carried out for the National Fund for Children program and the AQYL educational deposit. Sixteen articles were prepared and published outlining the benefits of saving for education and the opportunities provided by the program.

The Bank also responded to media inquiries, resulting in the publication of explanatory materials about its products and the results of the housing construction savings system on major information portals such as Kursiv.kz, Kapital.kz, inbusiness.kz, BES.media, Tengrinews.kz, krisha.kz, informburo.kz, and inform.kz.

As a result, more than 9,549 media publications featured mentions of the Bank in 2024.

The Bank’s official website underwent a major update in 2024 aimed at improving functionality and user experience. New landing pages were created and designed for key programs and products including National Fund for Children, Nauryz, Otau, Asyl Meken, collaboration with postmen from Kazpost JSC, as well as several regional housing programs.

The online mortgage calculator was enhanced to account for various evaluation scores. Key pages such as Digital Mortgage and Green Mortgage were updated, and the About the Bank section was refreshed with the latest information.

Significant improvements were made to the English version of the website, with around 20 pages updated. New pages were developed and added to highlight the Bank’s sustainable development initiatives.

These changes have made the website more modern, user-friendly, and informative, providing users with easier access to up-to-date information about the Bank’s products and programs.

The Bank’s website was successfully indexed by Google, meaning its new landing pages were added to Google’s search database and are now accessible via search queries. This has improved the visibility of the site and made it easier for customers to find information on the Bank’s products and services. As of the update on 31 December 2024, a total of 36,473 pages were indexed, indicating strong accessibility for search engines. All main sections and pages of the website are available to users via search.

During the reporting period, the most popular search query was “Otbasy Bank” with 1,400,965 clicks and 2,088,563 impressions, demonstrating strong brand-driven traffic.

Visitor traffic to the website increased by 125.38 percent, reflecting significant growth in user activity. The number of unique users rose by 27.32 percent. The share of new visitors increased by 0.82 percent.

Results from a marketing survey showed that 85.1 percent of respondents trust the Bank. Brand awareness reached 91.4 percent. Customer satisfaction index was maintained at 96.6 percent.