Economic Environment

Macroeconomic indicators

According to the baseline forecast, global economic growth is expected to remain steady at 3.2 percent in both 2024 and 2025, the same rate as in 2023.

Global inflation is projected to gradually decline to 5.9 percent in 2024 and 4.5 percent in 2025. Advanced economies are expected to return to their inflation targets sooner than emerging markets and developing countries. Core inflation, however, is expected to decline more gradually. In Kazakhstan, inflation is projected to fall to the range of 7.5-8 percent by 2025.

Fiscal policy remains expansionary, with the fiscal deficit expected to remain elevated at 3.1 percent of GDP in 2025, before narrowing to 2.7 percent in 2026. While public debt remains manageable, rising domestic borrowing costs and reliance on the National Fund for fiscal support pose challenges to long-term sustainability.

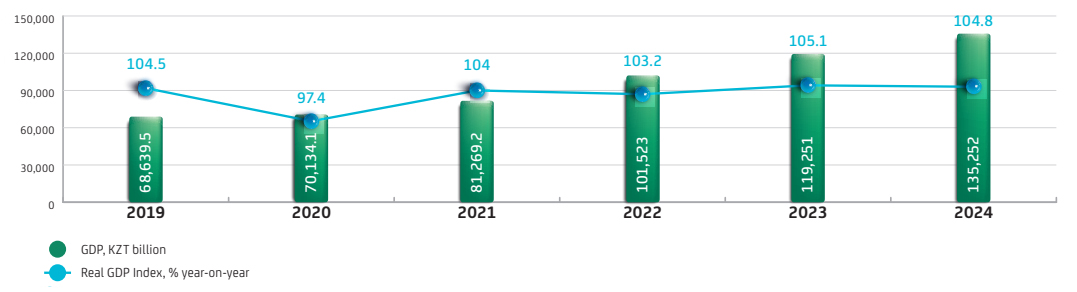

Kazakhstan’s gross domestic product (GDP) grew by 4.8 percent in 2024, down slightly from 5.1 percent in the previous year.

The national currency experienced sharp depreciation at the end of 2024, weakening by 9.1 percent over the quarter to KZT 525.1 per US dollar. Contributing factors included a strengthening US dollar, falling oil prices, and sanctions against Russia, which triggered heightened demand for foreign currency. Despite interventions by the National Bank of Kazakhstan totaling USD 1.3 billion and other stabilization measures, the exchange rate continues to show high volatility, indicating weak market liquidity and underlying structural challenges in the national economy.

As of 1 January 2025, Kazakhstan’s population reached 20,300.6 thousand people, including 12,795 thousand (63 percent) in urban areas and 7,505 thousand (37 percent) in rural areas. Compared to 1 January 2024, the population increased by 267.1 thousand people or 1 percent.

In the fourth quarter of 2024, the average monthly salary in Kazakhstan increased by 10.5 percent year-on-year and amounted to KZT 434,982.

The total area of the national housing stock reached 434.3 million square meters by the end of 2024, including 287.1 million square meters in urban areas and 147.2 million square meters in rural areas. Compared to the previous year, the housing stock expanded by 15.2 million square meters.

Housing provision per capita in 2024 reached 24.5 square meters, including 26.9 square meters in urban areas and 20.7 square meters in rural areas. This represents an increase of 0.6 square meters from the previous year.

Dynamics of Gross Domestic Product in the Republic of Kazakhstan

Key Indicators of the Banking Sector

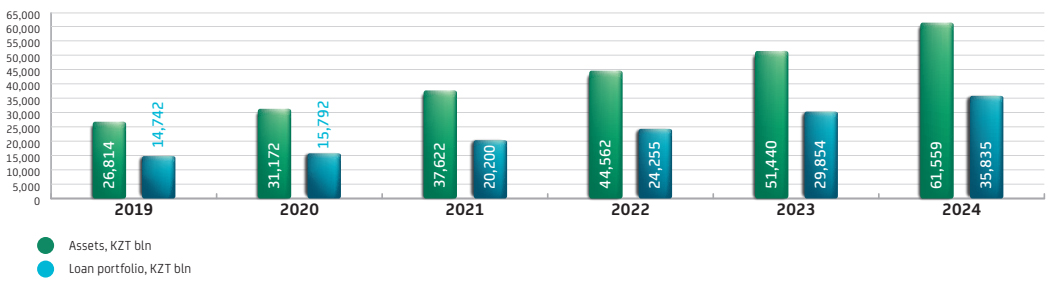

As of the end of 2024, the banking sector of the Republic of Kazakhstan consisted of 21 second-tier banks. The total assets of second-tier banks grew by 20 percent over the year and reached KZT 61.5 trillion.

Assets of second-tier banks as of 1 January 2025:

|

No. |

Bank Name |

Assets, KZT thousand |

|---|---|---|

|

1 |

Halyk Bank of Kazakhstan JSC |

17,941,741,778 |

|

2 |

Kaspi Bank JSC |

8,189,804,623 |

|

3 |

Bank CenterCredit JSC |

7,030,812,467 |

|

4 |

Otbasy Bank JSC |

4,279,614,316 |

|

5 |

ForteBank JSC |

4,112,145,508 |

|

6 |

First Heartland Jusan Bank JSC |

3,326,262,915 |

|

7 |

Eurasian Bank JSC |

3,142,702,412 |

|

8 |

Freedom Bank Kazakhstan JSC |

2,547,968,765 |

|

9 |

Bank RBK JSC |

2,452,692,704 |

|

10 |

Bereke Bank JSC |

2,445,232,022 |

|

11 |

Citibank Kazakhstan JSC |

1,174,475,453 |

|

12 |

Home Credit Bank JSC |

1,036,276,926 |

|

13 |

Altyn Bank JSC (Subsidiary Bank of China Citic Bank Corporation Limited) |

1,002,473,946 |

|

14 |

Shinhan Bank Kazakhstan JSC |

676,124,209 |

|

15 |

Nurbank JSC |

533,793,102 |

|

16 |

Subsidiary Bank of Bank of China Kazakhstan JSC |

477,094,455 |

|

17 |

Industrial and Commercial Bank of China in Almaty JSC |

358,221,019 |

|

18 |

Subsidiary Bank of Kazakhstan-Ziraat International Bank JSC |

295,840,718 |

|

19 |

Subsidiary Bank of Bank VTB (Kazakhstan) JSC |

244,400,004 |

|

20 |

Islamic Bank ADCB JSC |

239,724,519 |

|

21 |

Islamic Bank Zaman-Bank JSC |

52,017,533 |

|

|

TOTAL |

61,559,419,394 |

The largest share in the structure of total assets is occupied by the loan portfolio, which accounts for 58 percent. In 2024, the total loan portfolio of banks increased by 3 percent to KZT 35.8 trillion (as of 1 January 2025). Loans for housing construction and purchase increased by 10 percent and amounted to KZT 5.4 trillion.

Dynamics of assets and loan portfolio of the banking sector of the Republic of Kazakhstan

Loans to the economy issued by second-tier banks grew by 21 percent in 2024 and reached KZT 33.7 trillion (compared to 22 percent growth in 2023).

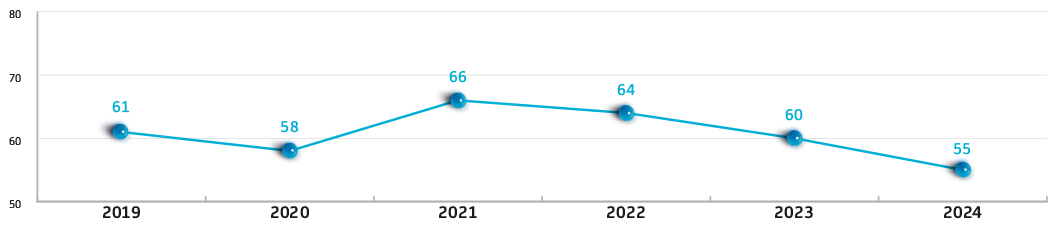

In recent years, Otbasy Bank JSC has remained virtually the only active player in the mortgage market among second-tier banks. Its loan portfolio increased by 6 percent in 2024, from nearly KZT 3.2 trillion to KZT 3.4 trillion. Each year, Otbasy Bank issues approximately 55 percent of all loans for housing construction and purchase in the country.

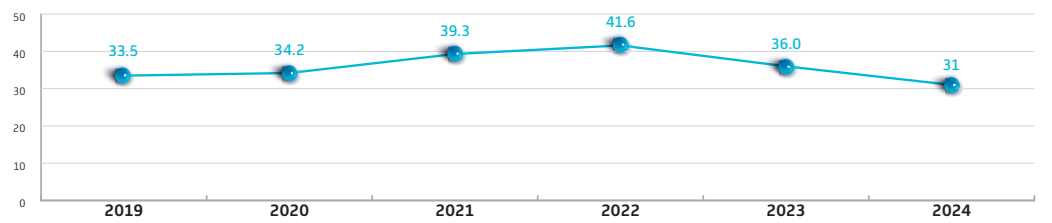

Otbasу Bank’s share in total second-tier banks’ housing construction and purchase lending, %

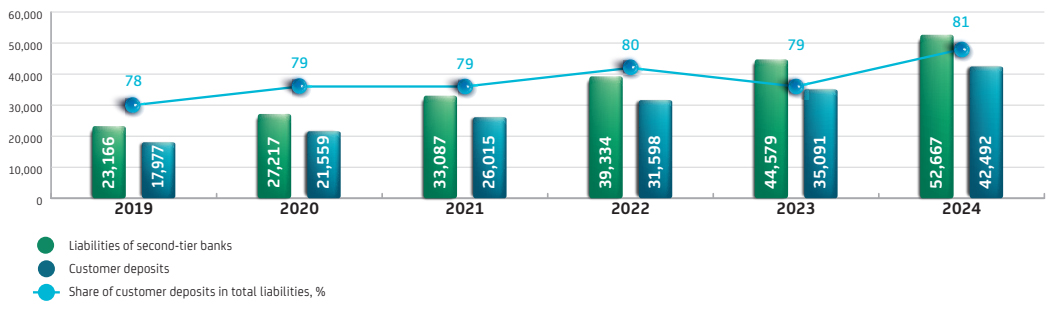

Dynamics of banking sector liabilities

Deposits from individuals in all second-tier banks increased by 20 percent in 2024 and reached KZT 24,521 billion. At the same time, the volume of deposits at Otbasy Bank rose by 3 percent (from KZT 2,362 billion as of 1 January 2024 to KZT 2,424 billion as of 1 January 2025).

Bank's share in the market of long-term deposits, %

The net profit of the banking sector in 2024 totaled KZT 2,555 billion. The profit of Otbasy Bank for the same period amounted to KZT 120.8 billion, which exceeded the planned target by 12 percent. Otbasy Bank’s strong performance in 2024 was driven by its competitive advantages, which allowed the Bank to maintain a successful development strategy.

Otbasy Bank’s growing market share and rising public interest in the housing savings system were positively influenced by the moderate expansion of second-tier banks and mortgage companies in the housing finance market, along with the introduction of new government and institutional housing programs aimed at expanding access to affordable housing in Kazakhstan. A steady increase in the number of participants in the housing savings system was observed, which contributed to the growth of both the Bank’s deposit base and loan volumes.

Compared to other second-tier banks in the country, Otbasy Bank demonstrates the following strengths and weaknesses:

Strengths

- Low interest rates on loans and state bonuses

- Capacity to implement large-scale government programs by aligning interests of various housing market participants

- Unique financial products addressing national social priorities

- Ability to improve housing conditions for the population

- Proven ability to reliably and securely manage customer savings

- Special tax benefits for housing savings participants

- Strong brand recognition

- Wide geographic presence

- International credit ratings on par with sovereign ratings

Weaknesses

- Limited product and service line

- Declining purchasing power of the population

- Gaps in legislation restricting potential service offerings

- Limited agility and flexibility of the quasi-public sector

In the long term, the Bank intends to leverage its strengths to consolidate its market position while continuously addressing the areas in need of improvement.