State Policy on the Housing Construction Savings System

Providing citizens with access to affordable, quality housing is one of the key priorities of Kazakhstan’s social policy. Economic growth and the government’s socially oriented approach have provided a solid foundation for the development of the Housing Construction Savings (HCS) system, which is regulated by the Housing Construction Savings in the Republic of Kazakhstan Act dated 7 December 2000.

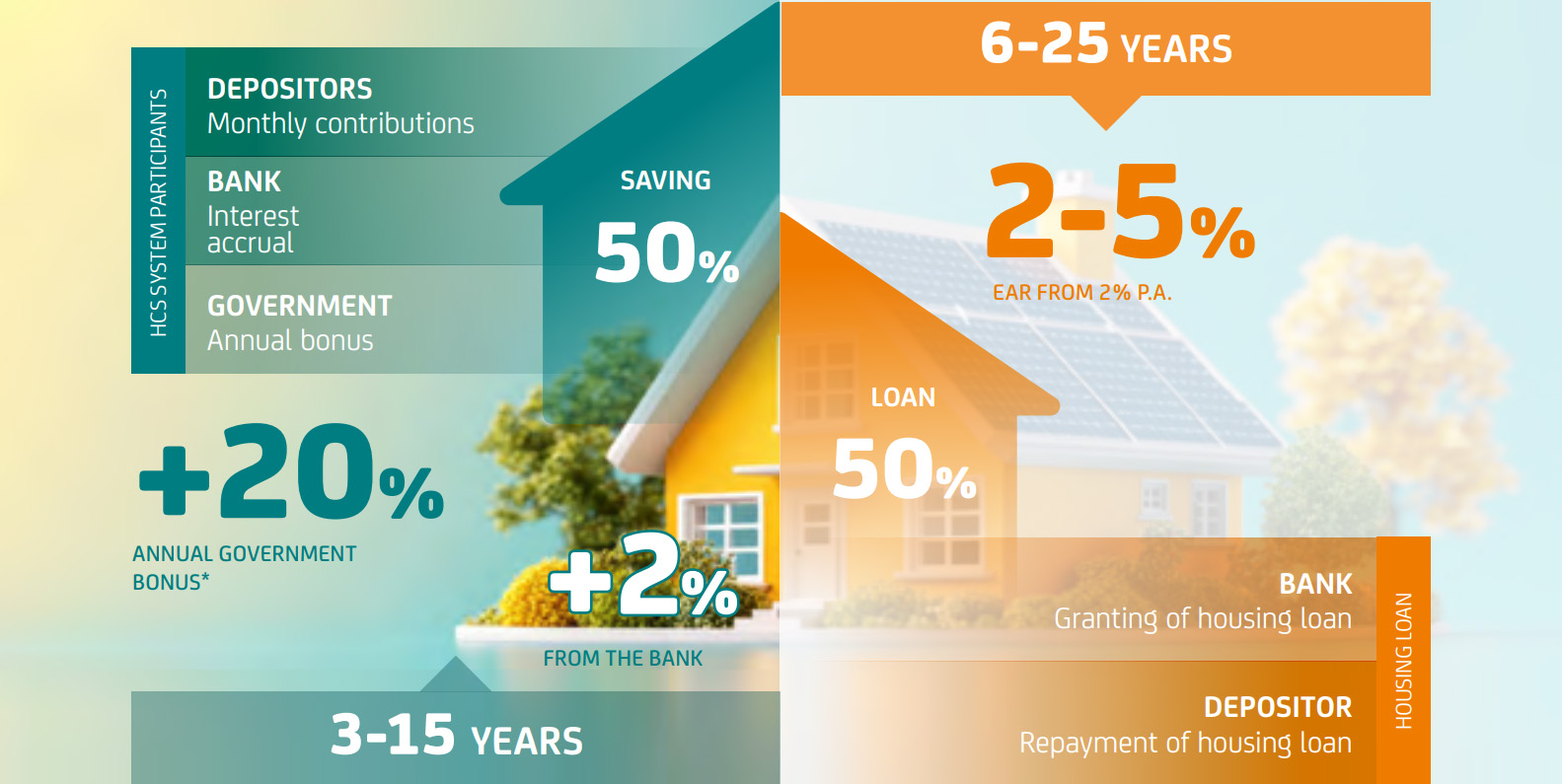

The HCS system is a closed-loop financing mechanism, where housing improvements are based on the accumulation of funds by depositors in savings accounts, followed by the provision of housing loans to those depositors. Kazakhstan’s HCS model is based on the German Bausparkasse system, which has also been widely adopted across Eastern Europe.

Having operated for over 20 years, the HCS system in Kazakhstan has become increasingly popular among the population.

Its distinguishing feature is the prior savings requirement, whereby customers deposit funds into their bank savings accounts to later become eligible for housing loans at low interest rates to improve their housing conditions.

Deposits made by citizens are incentivized with a state housing savings bonus (20% of the deposit amount, up to a limit of 200 monthly calculation indices (MCI)), regardless of ownership type, in accordance with the Housing Construction Savings Act of

the Republic of Kazakhstan.

In addition, depositors have the opportunity to purchase housing through government, regional, and Bank-run housing programs. Today, Otbasy Bank remains the only financial institution in

the country implementing the housing construction savings model.

A significant development was the designation of Otbasy Bank as a national development institution, with the mandate to carry out state housing policy, centralize the housing application queue, and offer integrated solutions through a “one-stop” approach to support improved housing conditions for citizens.

Housing Construction Savings System

Loan Purposes

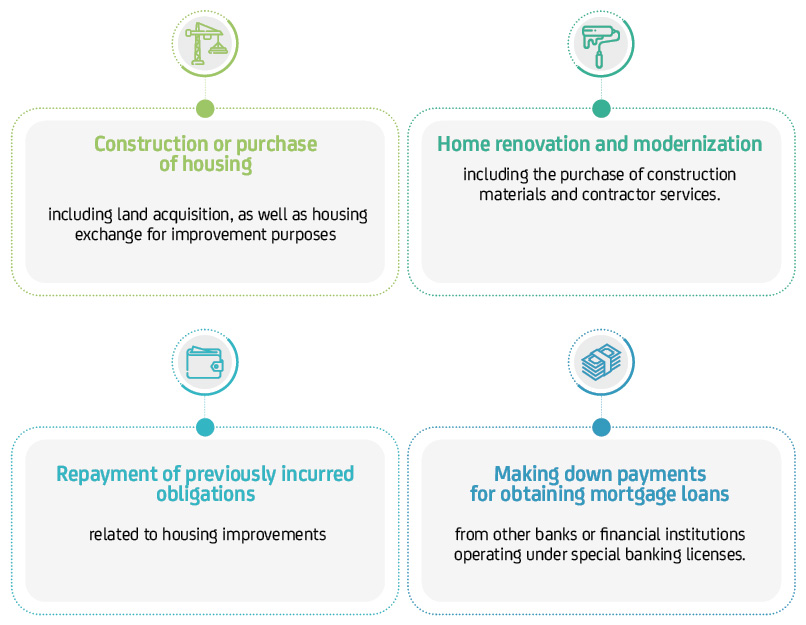

Otbasy Bank offers its depositors housing loans, preliminary housing loans, and interim loans to support activities aimed at improving their housing conditions, including: