About the Report

Otbasy Bank JSC (hereinafter referred to as Otbasy Bank or the Bank) recognizes the importance of its economic and social activities and seeks to ensure a high level of transparency for both internal and external stakeholders.

The Bank’s Sustainability Report for 2024 (hereinafter referred to as the Report) provides information on the Bank’s activities in the field of sustainable development, stakeholder engagement, employee support and development, respect for human rights, reduction of environmental impact, and contribution to national economic growth. The Report reflects the Bank’s approach to responsible business practices in alignment with the United Nations Sustainable Development Goals (SDGs) and in the interests of all stakeholders with whom the Bank interacts: customers, partners, investors, government authorities, suppliers, employees, and society at large.

The Report has been prepared in accordance with the Global Reporting Initiative (GRI) Standards, the Sustainability Accounting Standards Board (SASB) standards for the financial sector (Commercial Banks, Consumer Finance, Mortgage Finance), and also incorporates IFRS S2 (formerly TCFD), the Corporate Governance Code, the Bank’s Sustainable Development Policy, other internal documents, and the recommendations of the Agency for Regulation and Development of the Financial Market of the Republic of Kazakhstan (ARDFM) based on its ESG Disclosure Guidance for banks and other financial institutions, as well as international best practices.

This Report is the Bank’s fifth non-financial report and presents the Bank’s performance for the period from 1 January 2024 to 31 December 2024. The reporting period for both the Bank’s financial statements and this Sustainability Report is the same. The Report is reviewed by the Bank’s Strategy and Corporate Development Committee, Management Board, and the Strategic Planning and Corporate Development Committee of the Board of Directors, and is subsequently approved at a meeting of the Board of Directors.

The Bank publishes non-financial reports for a wide range of stakeholders and strives to present material information in a balanced manner that aligns with the interests of each group. The Bank is committed to continuously improving the quality of its disclosures. This Report has not been subject to external assurance.

Defining the Content of the Report

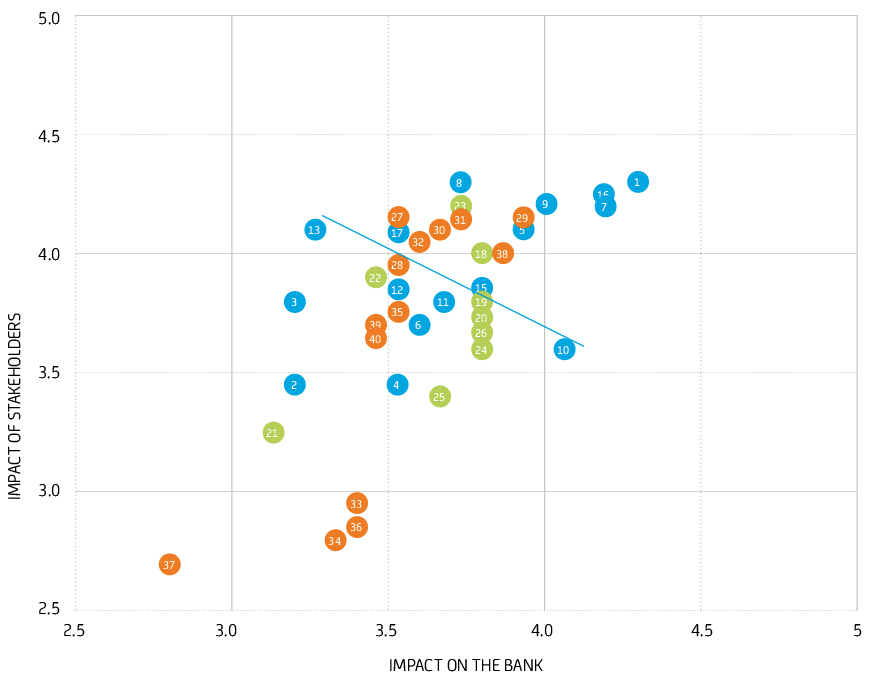

The process of identifying and assessing material topics was carried out in accordance with the GRI Standards. To determine the scope of information to be included in this Report, the Bank analyzed all sustainability topics proposed by the GRI Standards, SASB, IFRS S2, ARDFM, as well as best practices. The topics were assessed according to the degree of importance for the Bank, taking into account its development strategy, and according to the degree of importance for stakeholders, which was determined in the course of stakeholder engagement during the year. Additionally, the topics were assessed from the perspective of the Bank’s actual and potential impacts on the economy, environment, and people, including impacts on human rights, as well as from the perspective of external factors affecting the Bank itself, in line with the principle of double materiality.

As a result of this analysis, a questionnaire was developed and used to conduct a stakeholder survey. The survey participants included members of the Board of Directors, the Management Board, Bank employees, Baiterek NMH JSC, its subsidiaries, media representatives, external auditors, and others. The questionnaire was distributed to 32 participants, each of whom was asked to assess the importance of various topics for the 2024 Annual Report and Sustainability Report using a five-point scale, where a higher score indicated a more material topic. Each topic’s materiality was ranked in terms of importance to both internal and external stakeholders.

The results of the materiality assessment are presented in the form of a matrix. Topics highlighted in grey in the table below are considered the most significant for the Bank and its stakeholders. Based on the survey results, 15 key material topics were identified, each scoring above 4 points. Topics appearing in the top-right corner of the matrix were identified as the most material and are disclosed in this report. All material topics are fully covered in the Report.

Materiality Matrix

Report Boundaries

This Report contains information on the Bank’s sustainable development activities, covering the Bank’s Central Office and its branches. More detailed information on the Bank, including operational performance results, is disclosed in the Bank’s 2024 Annual Report. The 2024 Annual Report is available on the Bank’s official website at hcsbk.kz under the “About the Bank” / “Reporting” section. The boundaries for data collection on material topics have been defined to ensure the Report covers all the Bank’s most significant impacts.

Sustainability Performance Indicators

|

Indicator |

2022 |

2023 |

2024 |

|---|---|---|---|

|

Average headcount of Bank employees, people |

1 372 |

1 511 |

1 661 |

|

Average annual number of training hours per employee, person-hours |

24 |

14 |

13 |

|

Employee engagement rate, % |

79 |

79 |

78 |

|

Number of discrimination incidents on any grounds |

0 |

0 |

0 |

|

Number of injury cases |

0 |

0 |

0 |

|

Number of corruption offenses and violations |

0 |

0 |

0 |

|

Index of trust in the Bank’s activities, % |

88 |

86 |

85 |

|

|

Topics (topics highlighted in gray were identified as most material) |

Average Score |

|---|---|---|

|

1 |

Economic Performance |

4.4 |

|

2 |

Procurement Practices |

3.3 |

|

3 |

Business Ethics and Conduct |

3.6 |

|

4 |

Anti-Competitive Behavior |

3.6 |

|

5 |

Anti-Corruption |

4.1 |

|

6 |

Compliance Control |

3.8 |

|

7 |

Cybersecurity and Anti-Fraud |

4.3 |

|

8 |

Governance and Internal Control Systems |

4.1 |

|

9 |

Financial Inclusion |

4.2 |

|

10 |

Customer Privacy |

3.9 |

|

11 |

Loan Portfolio Risk Management |

3.9 |

|

12 |

Capital and Liquidity Management |

3.9 |

|

13 |

Management of Sustainability-Related Risks and Opportunities |

3.8 |

|

14 |

ESG Integration in Lending and Investment Activities |

3.8 |

|

15 |

Customer Engagement and Interaction |

4.0 |

|

16 |

Responsible Lending and Financial Products |

4.3 |

|

17 |

ESG Products and Services |

4.0 |

|

18 |

Electricity |

4.0 |

|

19 |

Thermal Energy |

3.9 |

|

20 |

Water and Effluents |

3.8 |

|

21 |

Biodiversity |

3.2 |

|

22 |

Waste Management |

3.8 |

|

23 |

Environment |

4.0 |

|

24 |

GHG Emissions |

3.7 |

|

25 |

Climate Change |

3.5 |

|

26 |

Climate-Related Risks and Opportunities Management |

3.8 |

|

27 |

Employment |

4.0 |

|

28 |

Labor/Management Relations |

3.9 |

|

29 |

Occupational Health and Safety |

4.1 |

|

30 |

Training and Education |

4.0 |

|

31 |

Diversity and Equal Opportunity |

4.0 |

|

32 |

Non-Discrimination |

3.9 |

|

33 |

Child Labor |

3.1 |

|

34 |

Forced or Compulsory Labor |

3.0 |

|

35 |

Security Practices |

3.7 |

|

36 |

Rights of Indigenous Peoples |

3.1 |

|

37 |

Local Communities |

2.8 |

|

38 |

Respect for Human Rights |

4.0 |

|

39 |

Diversity and Inclusion |

3.6 |

|

40 |

Charity and Volunteering |

3.6 |