Strategic Direction (Transformation in the Context of the Climate Agenda)

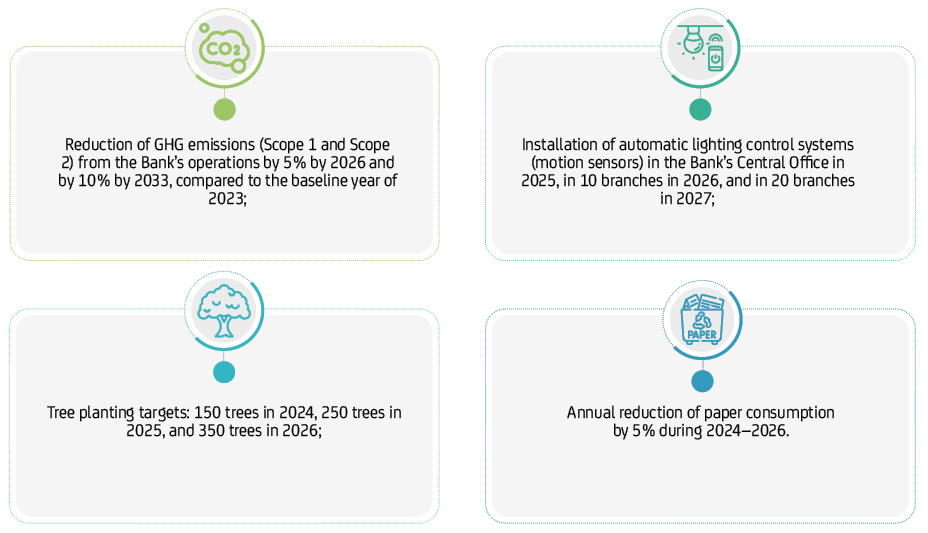

Otbasy Bank JSC considers climate change a strategically significant factor that can impact financial stability, the business model, and development priorities. ESG-related matters are an integral part of the Bank’s Development Strategy for 2024–2033. Strategic Key Performance Indicators (KPIs) encompass not only operational and financial indicators but also sustainability targets, particularly those related to climate. The following climate-related KPIs have been established:

The Bank’s environmental and climate-related goals are aimed at:

- Environmental protection, including the sustainable use of resources and reduction of the Bank’s impact on global climate change;

- Compliance with all applicable legal and other requirements adopted by the Bank;

- Implementation of environmentally friendly, energy- and resource-efficient technologies.

Special attention is given to the development of a green mortgage portfolio, including support for energy-efficient construction projects and the introduction of sustainable housing standards. The Bank aligns its activities with the Taxonomy of Green Projects of the Republic of Kazakhstan and the national Strategy for Carbon Neutrality by 2060. The implementation of climate initiatives is embedded within the broader ESG agenda of the Bank, including collaboration with international partners and a commitment to greater transparency.

In the reporting year, the following initiatives were carried out as part of ESG integration into the Bank’s core processes:

- A Sustainable Development Office was established within the Department of Planning and Strategic Analysis. Its primary function is to implement and coordinate sustainability and ESG-related matters;

- A number of internal documents were developed or updated to reflect evolving ESG standards. These include: the Social Bond Policy, Methodology for Assessing the Compliance of New Lending Programs with Sustainability Principles, Policy on Reducing Environmental and Climate Impact, Human Rights Policy, and others;

- For the first time, the Bank received an ESG rating from Sustainable Fitch, international rating agency: Rating Level – 3, ESG Score – 55;

- A fully operational section dedicated to sustainability was launched on the Bank’s corporate website to enhance disclosure quality;

- In cooperation with an external expert organization, the Bank developed a methodological approach for the quantitative assessment of Scope 3 emissions, including financed emissions;

- Together with international consultants, the Bank conducted a comprehensive climate-related risk and opportunity assessment, covering both physical risks (such as floods, inundations, and landslides) and transition risks (including regulatory changes in energy efficiency standards, market demand transformation, and evolving construction requirements). Based on this analysis, priority climate factors were identified, scenario assumptions were developed, and impact timeframes were defined (short-term, medium-term, and long-term), enabling the initiation of climate integration into strategic and budget planning processes.

Thus, climate-related risks and opportunities are becoming an essential part of the strategic development model of the Bank. This creates a resilient foundation for adapting to evolving conditions, meeting regulatory requirements, and positioning the Bank sustainably in the low-carbon economy of the future.